Compare Stepped vs Level Life Insurance Premiums

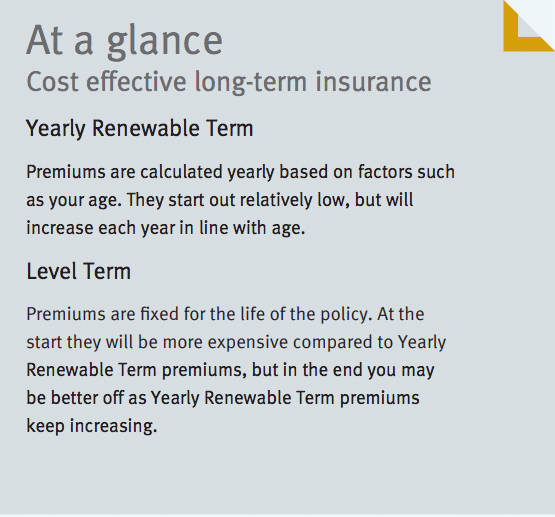

The main difference between Stepped vs Level premiums is stepped premiums start lower but increase because of your age and level premiums start higher but stay the same no matter your age.

Banks and many online insurance companies only offer premiums that increase. They will never tell you about premiums that don’t increase.

The sad part is, many kiwis are forced to reduce or cancel their life insurance policy when they need the protection the most, because of rapidly increasing insurance costs.

Stepped vs Level insurance premiums

Increasing Premiums vs Premiums that don’t increase with age.

The best life insurance companies in New Zealand offer stepped premiums and automatic conversion options to level premiums if you should decide to do so at any time. Without any further health assessment naturally.

Understanding stepped vs level premiums is paramount in determining how much you will be paying now, tomorrow and in the future.

For life insurance and trauma cover, you have the option to choose between stepped and level premiums.

Compare Stepped vs Level Premiums Guide

If you are interested in a particular topic, feel free to jump ahead:

1. Stepped Premiums Definition

Stepped premiums, also known as rate for age, are a great cost-effective way to get started with life insurance.

It is very important to understand that Stepped Premiums do increase with your age, but usually start cheaper than Level Premiums.

At the anniversary of the policy, banks and insurance companies recalculate the amount you pay for the life insurance policy.

Generally speaking, premiums increase year upon year because the likelihood of you making a claim rises every year.

There are exceptions.

Sometimes premiums can drop if you have stopped smoking or if you work in a less hazardous environment or maybe your health has improved.

Transitioning into family life for a young man is also a change in your circumstances.

These are all circumstances that if your insurer would reevaluate your policy, could mean lower premiums.

- Benefits of Stepped Premiums

Stepped vs Level Premiums start lower and are therefore more economic or budget-friendly to start off with.

Consequently, Stepped Premiums are a good affordable start getting financial protection for yourself and/or your family.

For many young people and young families, Stepped Premiums might just be the right solution because a life cover policy is within reach. Level Premiums might just put too big a stress on the family budget.

Often income rises as you age and you might afford Level Premiums later since they start higher.

- Stepped Premiums Disadvantages

Definitely, the longterm exponential price increases, because as you get older premiums become unaffordable.

As a result, many are forced to reduce life cover or cancel when they need it the most.

This is really absurd and contradictory to the purpose of having personal financial protection.

My thoughts anyway.

2. Level Premiums Definition

Level Premiums don’t increase with age.

Fixed life insurance premiums is a type of term insurance where the premiums stay fixed for a certain term.

Premiums are higher in the beginning but lower over time compared to stepped premiums.

- Benefits of Level Premiums

Level Premiums are also known as term life insurance, and premiums remain the same during the term of the contract. Comparing Stepped vs Level Premiums paid for this sort of a policy, premiums will be higher in the beginning and remain the same, whereas Stepped Premiums might have doubled many times throughout the same period.

Term Life Insurance or Level Premiums stay fixed during the term, which means life insurance premiums that don’t increase with age remain the same until your age 65, 70, 80, 90 or 100.

Worth noting here is that the longer you want life insurance premiums that don’t increase with age, the higher they are initially.

An example is if you want $100.000 life cover policy fixed until your age 70 and another life cover policy fixed until your age 100, the premiums per fortnight, for the later policy will be higher.

– Level Premiums Disadvantages

I would say the greatest disadvantage with Level Premiums is that you pay a higher cost now when comparing Stepped vs Level Premiums.

That makes Level Premiums for many people harder to afford.

Maybe in another couple years, Level Premiums are more affordable.

That is why it is so important to initially start with a life insurance company that offers hassle-free policy conversion from Stepped to Level Premiums.

3. Stepped vs Level Premiums: Policy Wording Comparison

The Policy Wording document is an essential document and stipulates how the legal agreement between the parties, insurer and insured will be enforced.

Therefore examining the policy wording gives us a better understanding of what it is we are actually buying.

In the following three examples, I am examining the Policy Wording for Asteron Life, Fidelity Life and Bank of New Zealand (BNZ).

Policy Wording Comparison – Stepped Premiums

Asteron Life

Stepped premiums increase over time.

We recalculate them every year on your policy anniversary. We advise you of the new premium in writing.

Asteron Life will base your new premium on:

- our stepped premium rates at that time

- the insured person’s sex, occupation, smoking status and any premium loading factors that we have agreed • any discounts you or the insured person qualify for

- the amount of cover (or sum insured) you have at that time; and the insured person’s age on their next birthday.

You can choose to increase your amount of cover each year, so it stays consistent with inflation. If you choose to do this, you will pay additional premium for the additional cover being added.

Comment:

Asteron Life recalculates premiums on your policy anniversary based on above criteria.

Fidelity Life

Policy Wording coming….

Bank of New Zealand (BNZ)

BNZ Life will calculate the premium on each Anniversary Date based on:

› the amounts of the Benefits;

› premium term selected

(note – Permanent Disability Benefit, Temporary Disability Benefit and the Redundancy Benefit, must have a premium term of one year);

› the Insured’s then age, gender and smoking status (premiums will generally increase with age);

› any additional premium loading agreed to by both Policy Owner and BNZ Life; and

› BNZ Life’s table of premiums and policy fees then in force.

BNZ Life may in its absolute discretion, recalculate the premium at any time (including any time which is not an Anniversary Date) if BNZ Life’s table of premiums and policy fees is revised in respect of all insureds with like cover.

Bank of New Zealand – BNZ Life must give the Policy Owner not less than 60 days notice of any change in premium which will come into force at any time other than an Anniversary Date.

Comment:

Bank of New Zealand (BNZ) recalculates premiums annually based on the above criteria and may in its absolute discretion, recalculate premiums at any time, including the policy fees.

Policy Wording Comparison – Level Premiums

Asteron Life

Level premiums stay the same each year until your level premium term expires.

They will not increase during this time unless:

• you choose to increase or decrease your amount of cover

• you choose to change your payment frequency from yearly to half-yearly, quarterly, monthly or fortnightly

• we change the premium rates because of the cost of providing protection (we won’t ever do this for level premiums on Life Cover)

• we change the premium rates because of increases to government taxes or charges (section 11.3.2, 11.3.3)

• you choose to increase your amount of cover each year in line with inflation.

If you choose to do this, you will pay an additional premium for the additional cover being added

Comment:

Asteron Life guarantees never to increase level premiums. The exception is if the government increases taxes or charges and you have the option to inflation adjust the amount of cover.

Fidelity Life

Policy Wording coming….

Source: https://www.fidelitylife.co.nz/life-assurance/

Bank of New Zealand (BNZ)

Bank of New Zealand does not offer Level Premiums.

4. Stepped vs level premiums graph

The Reserve Bank of New Zealand defines inflation

as the term used to describe a rise in average prices through the economy. It means that money is losing its value.

Inflation in New Zealand is measured by the Consumer Price Index also CPI and published by Statistics New Zealand.

When buying life insurance, stepped or level premiums, you can choose to CPI-inflation adjust your policy.

Afterall, we know $250.000 today and $250.000 20 years ago does not equal same buying power.

The following two examples demonstrate stepped vs level premiums and non-inflation vs inflation adjusted policies.

-Study case #1

The above chart shows how stepped vs level premiums develop, ex CPI for a 42-year old, none smoker male until age 80. Based on insurance rates from Asteron Life.

Life Cover is $250.000, fortnightly payment.

Please note, these figures are without inflation adjustment.

Actual numbers based on January 2018 prices.

| Age | Stepped | Level to 80 |

| 41 | $30.19 | $78.97 |

| 46 | $43.97 | $78.97 |

| 51 | $73.72 | $78.97 |

| 56 | $124.03 | $78.97 |

| 61 | $236.03 | $78.97 |

| 66 | $463.31 | $78.97 |

| 71 | $942.81 | $78.97 |

| 76 | $1,584.19 | $78.97 |

| 80 | $2,358.13 | $78.97 |

– Study Case #2

The above chart shows how stepped vs level premiums develop incl CPI for a 42-year old, none smoker male until age 80. Based on rates from Asteron Life.

Life Cover is $250.000.

Please note, these figures are WITH CPI inflation adjustment.

Numbers based on January 2018 prices.

| Age | Stepped | Level to 80 |

| 41 | $54.71 | $152.28 |

| 46 | $100.26 | $169.40 |

| 51 | $199.76 | $197.15 |

| 56 | $393.11 | $247.56 |

| 61 | $802.61 | $334.35 |

| 66 | $1,687.20 | $484.80 |

| 71 | $3,254.98 | $684.91 |

| 76 | $4,123.86 | $733.86 |

| 80 | $6,908.13 | $1,037.14 |

5. People Also Ask

Some frequently asked questions

What happens when my Level life insurance policy ends?

Four options if your level life insurance is expiring

- Renew the policy

- Buy a new policy

- Convert to stepped policy

- Drop life insurance

6. Which one is right for me?

There is no one-size-fits-all with life insurance.

Stepped vs level premiums is about your short- and long-term financial goals, current assets, debts, cash flow and your approach to risk.

It comes down to estimating stepped vs level premiums vs short- and long-term affordability and goals.

And both premium structures have their advantages. It depends on your circumstances.

Stepped premiums could be the better option for you if you are planning on keeping insurance for a short period.

If you want certainty and long-term affordability, Level Premiums could be right for you. Especially if you are struggling with exponentially growing premiums.

Another option is to combine both premium structures.

7. Benefits of Working With an Insurance Broker

LifeCovered works with the all best life insurance companies in New Zealand.

This gives you choice, efficiency and tailored coverage.

Think about it.

Working with many companies, we are in a much better position to find you an insurance company that fits you.

My team and I are here to serve you.

It’s free……well not really…..In life, there are no free sandwiches. We all know that.

But if we end up doing business together, you should know, that the insurance company will pay LifeCovered a commission.

You get the same price if you work with me as a broker or work directly with an insurance company.

You are welcome to comment below, and I will try to answer your questions regarding Stepped vs Level Premiums.

Free life insurance quotes in minutes